Understand the Conveniences of Buying Gold Jewellery as a Financial Possession

Gold jewellery has actually long been regarded as more than simple accessory; it stands as a durable financial possession with complex advantages. Integrating gold jewellery right into a varied profile can reduce dangers linked with market fluctuations. Beyond its monetary benefits, the cultural and sentimental relevance of gold jewelry includes layers of value.

Historical Value Retention

Just how has gold took care of to maintain its allure and value throughout centuries? The enduring charm of gold can be connected to its inherent qualities and historical importance. As one of the earliest metals to be found and utilized by people, gold has actually been prized for its rarity, pliability, and glossy elegance. Its unique residential properties have actually allowed it to act as an icon of wide range and power throughout numerous human beings, from old Egypt to the Roman Realm and past.

Historically, gold has played an important function in economic systems as a circulating medium and a criterion for money. This enduring association with monetary systems underpins its regarded security and dependability as a store of value. Unlike various other products, gold does not stain or rust, which ensures its longevity and continual need.

Culturally, gold jewellery has actually stood for both personal adornment and a substantial possession that can be passed down via generations, protecting riches and tradition. Its worth retention is additional bolstered by its global recognition and acceptance, going beyond geographical and cultural borders. These characteristics collectively add to gold's ability to keep its appeal and relevance as a beneficial monetary asset gradually.

Hedge Versus Inflation

Gold jewelry offers as an effective inflation-hedge, using defense against the erosive impacts of climbing rates. As inflation wears down the buying power of money, tangible assets like gold keep their inherent value, making them a reputable shop of wide range.

Unlike fiat currencies, which can be subject to manipulation and devaluation by governments, gold's value is naturally secure. Capitalists looking for to diversify their portfolios often transform to gold jewelry to counter the dangers connected with currency devaluation and financial chaos.

Easy Liquidity Choices

Unlike several other kinds of investment, gold jewelry can be rapidly transformed into cash money. Gold jewellery can be marketed or pawned at local jewelry stores, pawnshops, or with online systems, providing several methods for liquidation.

The process of selling off gold jewellery is somewhat straightforward. Jewellery items are generally evaluated based on their weight and purity, with the existing market rate for gold identifying their cash money value. This standardized and transparent approach of valuation aids in attaining fair costs, decreasing the risk of monetary losses throughout liquidation. In addition, the popularity of gold jewellery in social and financial contexts worldwide improves its resale worth, ensuring that it remains a robust monetary property.

Profile Diversification

Integrating gold jewelry into a financial investment portfolio can supply considerable diversification advantages. Full Report This rare-earth element often acts differently from various other asset courses, such as bonds and stocks, which are at risk to market volatility and economic changes. Gold's unique buildings allow it to function as a hedge against rising cost of living and currency changes, therefore providing security when typical assets fail. By including gold jewellery, financiers can minimize risks and potentially improve the total performance of their portfolios.

Gold jewellery is not only a concrete possession yet additionally retains intrinsic value, independent of monetary market problems. Unlike paper possessions, which can come to be pointless in severe circumstances, gold has a historic reputation for preserving wealth. Its innate value stays fairly steady, offering a trustworthy shop of worth gradually. This security is especially attractive during periods of economic uncertainty or geopolitical tensions, when capitalists look for safe-haven properties.

Moreover, gold jewelry's worldwide charm and demand make certain liquidity, making it possible for financiers to rapidly convert their holdings right into money if needed. This liquidity can be critical for rebalancing profiles or confiscating new investment chances. Eventually, incorporating gold jewelry offers a strategic benefit, improving portfolio resilience and cultivating long-lasting economic security.

Sentimental and cultural Worth

The cultural and nostalgic worth of gold jewelry is a substantial factor that establishes it apart from various other forms of investment. Unlike supplies or bonds, gold jewelry often transcends mere financial well worth, personifying ingrained individual memories read what he said and cultural traditions.

Furthermore, gold jewellery frequently carries sentimental worth, gave via generations as treasured treasures. These pieces can evoke individual and domestic histories, offering as substantial links to the past. The emotional attachment connected with gold jewelry can make it a treasured asset, valued not merely for its monetary well worth however, for its capacity to maintain and convey family members narratives and customs.

Conclusion

Spending in gold jewellery provides significant benefits as a monetary possession. Diversification via gold jewelry decreases exposure to traditional market threats.

Beyond its economic benefits, the cultural and nostalgic importance of gold jewellery adds layers of worth (gold jewellery dubai). Gold jewellery can be marketed or pawned at local jewelry stores, pawnshops, or with online systems, offering informative post numerous avenues for liquidation

The appeal of gold jewellery in social and economic contexts worldwide enhances its resale worth, guaranteeing that it continues to be a robust monetary property.

Gold jewellery is not just a tangible possession yet also preserves intrinsic value, independent of economic market conditions. The emotional add-on associated with gold jewellery can make it a valued asset, valued not simply for its financial worth but for its capability to communicate and maintain family narratives and customs.

Jennifer Grey Then & Now!

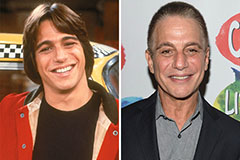

Jennifer Grey Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now! Susan Dey Then & Now!

Susan Dey Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now!